- Getting Started

- Use Case

- Message Type

- Sales

- Void

- Refund

- Inquiry

- Pre/Init Recurring

- Recurring

- Init Installment

- Installment

- Terminate

- PreAuth

- Sales Complete

- Message Table

- Tool

Need a custom solution?

Request DemoUse Case

Our APIs can be used to enable users to checkout from online stores and offer subscription services.

If our API is unable to meet your requirement, request a demo. Our team is ready to explore solutions with you.

Use Case Summary

Quick reference for supported use cases.

| Use Case | Description | Payment Methods | Typical Scenarios | APIs / Endpoints |

|---|---|---|---|---|

| Checkout / Sales | Standard checkout flow for one-time payments via hosted or non-hosted pages | FPX, e-Wallets, VISA, Mastercard | E-commerce checkout, service payments | /mercReq, /mpReq |

| Channel Inquiry | Retrieve available FPX banks and e-wallets for a given session | FPX, e-Wallets | Dynamic payment option display, channel availability checks | /channels |

| Pre-Authorization | Reserve a payment amount before finalizing the transaction | VISA, Mastercard | Hotels, tours, variable pricing services | /mercReq, /mpReq |

| Split Payment / Subscription | Split a payment over time or create recurring billing | VISA, Mastercard | Subscriptions, installment plans, memberships | /mercReq, /mpReq |

| Payment Reversal / Cancellation | Void or refund completed transactions | FPX, e-Wallets, Cards | Order cancellation, refunds, failed fulfillment | VOID, REFUND, INQ |

Checkout/Sales

Add a payment gateway to your online store with support for FPX, e-Wallets, and VISA/Mastercard payments. Paydee’s SALES API enables a unified checkout experience, including *Frictionless Flow (new) for eligible card transactions. Click any of the following options to see how these payment pages work.

Available payment channels are dynamically determined via the Channel Inquiry API.

Card Holder Name: Test User

Expiry: 2608

CVV: 123

Frictionless Checkout Experience

|

VISA |

4100000000000100

|

|

Mastercard |

5100000000000107

|

Challenge Flow Checkout Experience

- OTP:123456

|

VISA |

4100000000005000

|

|

Mastercard |

5100000000005007

|

Failed Checkout Experience

|

VISA |

4100000000300005

|

|

Mastercard |

5100000000300002

|

Hit refresh to checkout again.

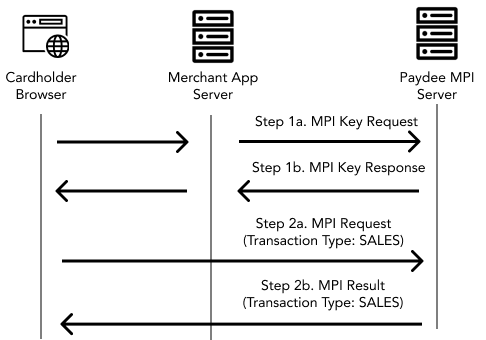

Message Flow

Important flows for Checkout/Sales.

| End Point | Information |

|---|---|

| /mercReq | The checkout page will be rendered by Paydee |

| /mpReq | Use this to customize the experience of your checkout page. |

Channel Inquiry

This flow highlights the handshake to retrieve the list of available e-wallets and FPX bank list. For non-hosted flows, the service provider is required to disable non-available channels; therefore, it is imperative that the system implementer retrieve the list of available channels frequently.

| End Point | Information |

|---|---|

| /channels | To retrieved available e-wallets & IBG banks |

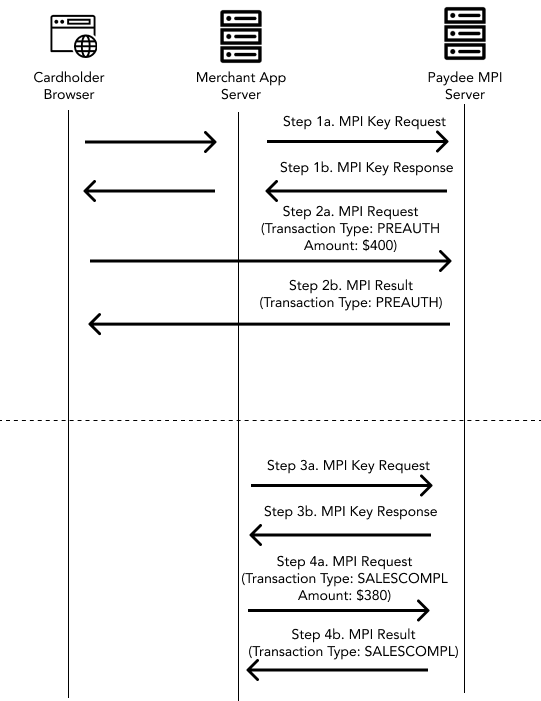

PreAuth

At times, the final amount may be undefined and unknown. One such use case is a tour package where travellers may easily exceed the base tour package amount. Merchants may pre-authorized (PREAUTH) the transaction with a pre-agreed amount plus typical additional service chages before completing the transaction with a Sales Complete (SALESCOMPL).

Message Flow

Important flows for PreAuth.

| End Point | Information |

|---|---|

| /mercReq | The checkout page will be rendered by Paydee |

| /mpReq | Use this to customize the experience of your check out page. |

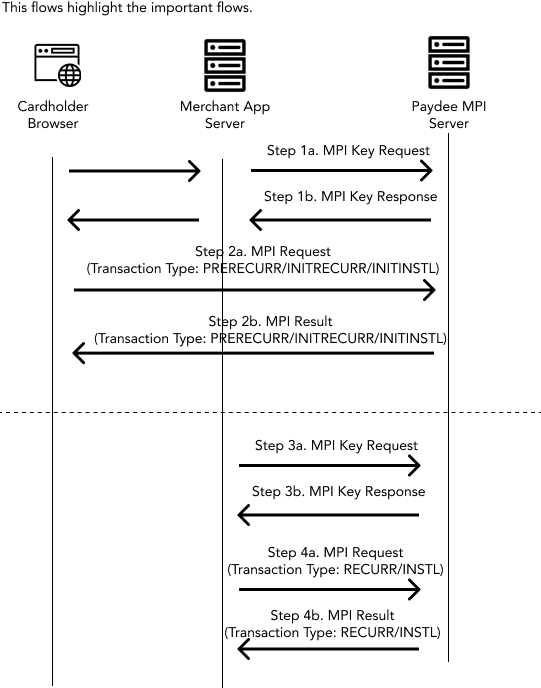

Split Payment

Paydee’s Split Payment API gives you the ability to split a single payment over a period of time or create a subscription-base service.

The API would firstly validate the card by attempting to charge RM1.00 (or another value) on it. Our API would attempt to validate the cardholder through 3DS flow. This amount usually reverts back to the cardholder unless you wish not to. We have all bases cover.

Flow Control Parameter

Important control parameters for Split Payment.

| Control | Uses |

|---|---|

| Frequency | Controls interval between payments (in days) |

| Expiry | Controls when the split payment arrangement shall end |

| Count | Controls the maximum number of payments |

| Maximum Amount | Controls the maximum payment amount |

| Total Amount | Controls the accumulated payment amount |

| Terminate | Terminates the split payment |

Message Flow

Important flows for Split Payment.

| End Point | Information |

|---|---|

| /mercReq | The checkout page will be rendered by Paydee |

| /mpReq | Use this to customize the experience of your check out page. |

Payment Reversal or Cancellation

Paydee allowed for a successful payment to be reversed or cancelled. The MPI supports VOID and REFUND method. A void transaction invalidates a payment before it's settled and finalized.

From the perspective of the payer and buyer, the transaction payment never happened - it won't appear on the merchant's or customer's financial statements, and you won't be charged payment processing fees for the transaction.

To ensure success, it's best to void a transaction as soon as possible, see the timetable below.

Void/Refund Reference Table

| Payment Channel | Void/Refund/Both | Cut-off time for void request | Processing Method | Credit to buyer within |

|---|---|---|---|---|

| Credit/Debit card | Both | 11:30pm GMT+8 | ||

| Boost | Both | 11:59pm GMT+8 | Auto | 1-business day |

| TnG e-Wallet | Both | 11:59pm GMT+8 | Auto | 1-business day |

| Grab Pay | Both | 11:59pm GMT+8 | Auto | 1-business day |

| Maybank QR Push | Refund | Manual | 7-business day | |

| Alipay | Both | 11:59pm GMT+8 | Auto | 1-business day |

When a transaction has been settled, the fund would be sitting in the merchant account. The merchant would need to agree to refund the money back to the buyer. With the refunds, both the original transaction and the refund appear separately on the merchant's and customer's financial statements.

Special Notes:

When you trigger VOID or REFUND message, a MPI server may reply Error Code: 00 . The Code 00 means that the message has been received and will be processed. It doesn't imply that the VOID/REFUND is finalized.

You should perform an INQ 30 minutes later, to inquire the status of the transaction. The field 'Payment Status' would show the reversal status of the transaction.

Void/Refund Reference Table

| Payment Channel | Void/Refund/Both | Cut-off time for void request | Processing Method | Credit to buyer within |

|---|---|---|---|---|

| Credit/Debit card | Both | 11:30pm GMT+8 | ||

| Boost | Both | 11:59pm GMT+8 | Auto | 1-business day |

| TnG e-Wallet | Both | 11:59pm GMT+8 | Auto | 1-business day |

| Grab Pay | Both | 11:59pm GMT+8 | Auto | 1-business day |

| Maybank QR Push | Refund | Manual | 7-business day | |

| Alipay | Both | 11:59pm GMT+8 | Auto | 1-business day |

The Webservices are documented in Open Specification 3.0. Click the button below to view & test drive the WebServer.

SpecificationIMPORTANT Please implement your check-out page in iframe as per EMV 3D Secure 2.0 Specification.